Paycheck estimator calculator

The Paycheck Calculator below allows employees to see how these changes affect pay and withholding. The Tax Withholding Estimator can help navigate the complexities of multiple-employer tax situations and determine the correct amount of tax for each employer to withhold.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. These calculators are not intended to provide tax or legal advice and do not represent any ADP. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. The employer has both required and discretionary payments that it makes on behalf of the employee.

N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. Dont want to calculate this by hand. Important note on the salary paycheck calculator.

Tax Guides. The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability. A financial advisor in Minnesota can help you understand how taxes fit into your overall financial goals.

Diversity Equity Inclusion Toolkit. Paycheck Protection Program Guide. How You Can Affect Your Minnesota Paycheck.

Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. Click here for a 2022 Federal Tax Refund Estimator.

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Enter the required information into the form to instantly get your results.

Compare taxable tax-deferred and tax-free investment growth. This is tax withholding. The PaycheckCity salary calculator will do the calculating for you.

Find payroll and retirement calculators plus tax and compliance resources. The calculator will also provide your FIRE age which is the age when you can expect to achieve FIRE and be able to retire. 2022 Salary Paycheck Calculator Usage Instructions.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Any other use is strictly prohibited. Social Security Retirement Estimator.

Then enter the employees gross salary amount. Attend webinars or find out where and when we can connect at in-person. Use Withholding Calculator to help get right amount for 2019.

Amount of money you have readily available to invest. This calculator can convert a stated wage into the following common periodic terms. Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck.

Are you looking for more information about a wage offered by a prospective employer. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Free W-4 Estimator Creator.

Feel free to run different scenarios through the calculator. But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll.

Federal Income Tax Calculator 2022 federal income tax calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial data. Maximize your refund with TaxActs Refund Booster.

P Principal Amount initial loan balance i Interest Rate. Your household income location filing status and number of personal exemptions. The Math Behind Our Mortgage Calculator.

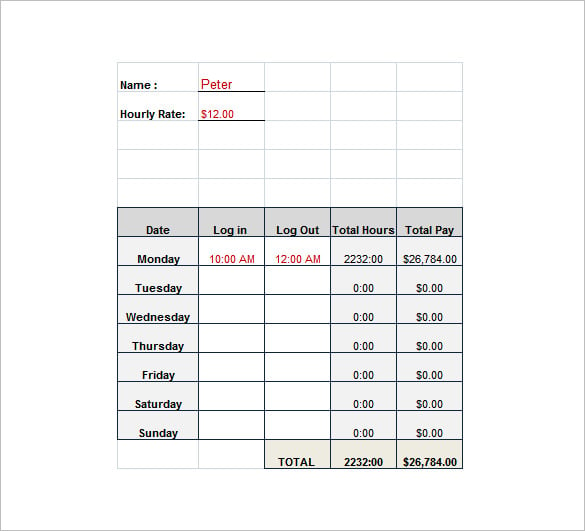

Our free salary paycheck calculator see below can help you and your employees estimate their paycheck ahead of time. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. Account for interest rates and break down payments in an easy to use amortization schedule.

The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers. Exempt means the employee does not receive overtime pay. M Monthly Payment.

This number is the gross pay per pay period. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

The Liberty Withholding Calculator is not intended to serve as an online tax preparation tool for either a federal or state income tax return or any other return. Use this calculator to help illustrate the total compensation package for an employee. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

IR-2019- 107 IRS continues campaign to encourage taxpayers to do a Paycheck Checkup. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Capital gains losses tax estimator.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Subtract any deductions and payroll taxes from the gross pay to get net pay. Hourly weekly biweekly semi.

If you want to adjust the size of your paycheck first look to. Use our free mortgage calculator to estimate your monthly mortgage payments. Use any of these 10 easy to use Tax Preparation Calculator Tools.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. See how your withholding affects your refund take-home pay or tax due.

Fields notated with are required. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Liberty Withholding Calculator is a tax estimator tool only and should only be used to calculate an individuals estimated tax withholdings.

Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. You may find youll need to contribute more money to your investment and retirement accounts or experiment with different rates of return to meet your goals. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section P163 you will see your per paycheck tax withholding amount. You can also use the calculator to calculate hypothetical raises adjustments in retirement contributions new dependents and changes to health. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

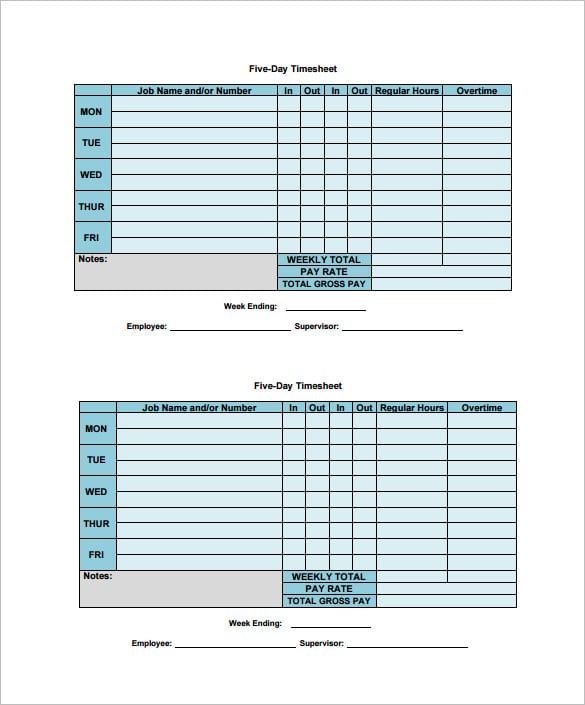

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Take Home Pay Calculator

10 Free Hourly Paycheck Calculator Excel Pdf Doc Word Formats

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Hourly Paycheck Calculator Step By Step With Examples

Paycheck Calculator Online For Per Pay Period Create W 4

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Template Download Printable Pdf Templateroller

California Paycheck Calculator Smartasset

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Us Apps On Google Play

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ready To Use Paycheck Calculator Excel Template Msofficegeek